Happy new year everyone and welcome 2025! I am a week past due on the first newsletter of the 2025 had some stuff going on, the important thing is – we are here and now.

Thank you to everyone who’s spent give or take 10 mins / week (give or take) with me to read, send DMs, suggest topics and debate my POV on all things global mobility last year and in years past. I ALWAYS value constructive feedback and differing points of view so please don’t hesitate to send me your thoughts and questions. I can try to answer them in upcoming newsletters.

Lots to go over, so I’ll break this week’s newsletter up into two bites.

Some of what I’ll go over in the next two newsletters:

- Review of 2024

- 2025 predictions

- CES

- Year-end sales numbers for (almost) everyone in China

- Housekeeping

We’ve picked up a few new readers (and I should do this periodically anyway) and since many of you know me ONLY through word of mouth from one of your trusted sources …allow me to re-introduce myself.

Tu Le here. My day job is Managing Director at Sino Auto Insights, a management consultancy that helps organizations build the future of transportation and mobility. It was founded in Beijing, China where I spent 12 years living and working (and another ~1 year in Shanghai w/ Ford). We’ve recently been very popular with investment firms and risk management teams that are trying to navigate the (recently) increasingly complicated global automotive / transportation / technology waters. 6 days from now, even moreso.

I launched this newsletter at around the same time I founded the consultancy, almost 7 years ago because I foresaw what is happening before our eyes now. That tech and auto wouldn’t get along, the Chinese were building strong players and weren’t f*cking around. Software was going to be much, much, much harder than Legacy OEMs thought it was going to be and that moving as fast as the Chinese at anything was going to be a VERY huge uphill climb.

The bottom line – the global automotive industry wasn’t prepared for what was going to happen to them, I knew they were going to lose, how much is what was still uncertain back then. What I underestimated (and EVERYONE did for that matter) was how fast and big the Chinese EV sector would grow to in such a short time

I’ve also spent time working in Detroit and Silicon Valley for these companies: Apple, Logitech, GM and Lear.

I also co-host the weekly China EVs & More podcast with good friend, Lei Xing. We are two of the best at it. FULL STOP. We talk the talk, then walk the walk.

For those wondering what the difference between the two is, let’s first start with the similarities. They both answer the ‘whys’ about, not only the Chinese market, but also Chinese players in the EV, battery, silicon, AV and auto-related technology spaces. It’s what I’d consider one of the most important things that analysts need to understand the decisions being made.

Finally, I work to help stand up mobility startups all over the world, many of them in Detroit where I spend my time when I am not on a plane, at a conference or visiting a mobility company. I am passionate about all of this, which makes me very lucky.

There’s always a lot of Monday AM QB’ing from those trying to talk the talk on why China is just better and faster right now than most and we can debate about the ‘how’ and ‘why,’ what we can’t argue about is that Chinese consumers bought about 11M NEVs in 2024 out of a total global 17.1M (according to Rho Motion). That’s 64% of the global share.

In China, consumers bought a total of ~23M vehicles in 2024. So simple math says they are at almost a 50% take rate. In fact, the last few months of the year, they were over 50%. For 2025, it should be well above 60ish%. He Xiaopeng and Li Bin believe that the take rate will be >80% before 2030.

First, a bit of reflection on 2024, I’ve browsed all of the 43 newsletters I sent last year and will bring back a few posts I thought hit the right note starting with the one below.

First piece I reflect on: My post AutoBeijing 2024 newsletter, you can find here.

QUOTED / INTERVIEWED

Joe Lowry’s Global Lithium podcast. I was his guest this week. For those who do not know who Joe Lowry is, he’s like me and old China hand that knows where the bodies are buried and has the actual receipts. He’s knowledgeable, informative and doesn’t take himself too seriously.

Joe is my go to for ALL THINGS lithium. One of the most important, if not the most important mineral being used in the global automotive sector as it transitions to clean energy. His podcast is downloaded in 180 countries so I am not the only one that listens to him. Make sure to have a listen.

CNBC interview

Had the pleasure of speaking with CNBC while I was in Vegas, baby, Vegas to talk CES and few other things, you can check that video out here.

As for my first time at CES, it was all that and more. It was the largest trade show I’ve been to. Vegas was kind with its not so cold weather. I didn’t realize this, but I hadn’t been back to Vegas in about 10 years, oh how it’s really changed.

Food is so expensive, eye-wateringly so. And I didn’t hit the tables as much as I thought I would’ve. I was so beat after walking the halls, talking to people I met, attending after conference happy hours. It was a great atmosphere and truly is a spectacle for those wondering if they should attend.

Highlights for me.

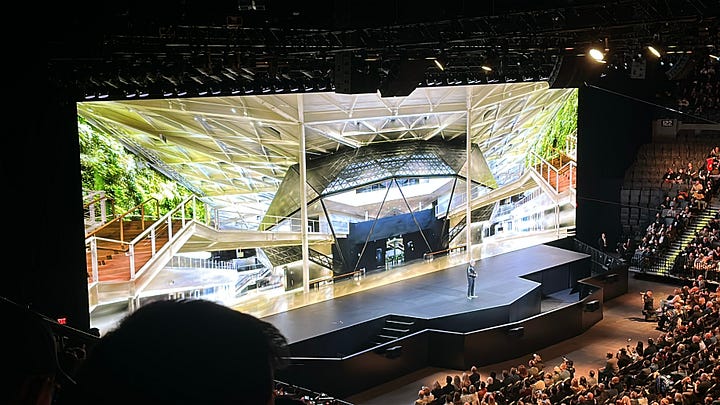

- Watching Jensen Huang, along with 12K of his closest friends do Nvidia’s keynote.

The queue to see Nvidia’s keynote.

The above video is Jensen intro’ing Nvidia’s newest gfx card, the GeForce RTX 9050

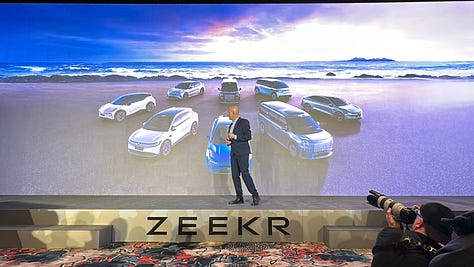

- Attending the Zeekr press event then walking over to see and hear the oohs and aahs that came from folks that got in and out of the three vehicles on display at the booth. Patrick George captures this well in his InsideEVs piece you can find here.

- John Deere presser unveiling humungous autonomous loaders and mining trucks.

- Attending the XPeng Aeroht presser and sitting down to chat with Brian Gu, President of XPeng. It’s been recorded and is now being edited as we speak so stay tuned, he had SO MUCH to say!

- Attending the Indy Autonomous Challenge race at the Las Vegas Speedway where 9 university teams competed with their autonomous F1 style vehicles raced one another. It was the first time that 4 autonomous race cars shared the same track at once!

4 Autonomous race cars on the track at once, the first time that’s been done!

The mobility hall was smaller than in years past but I didn’t notice that. If I can think of anything else about CES, I’ll post it in part 2 of this newsletter.

___

FINAL FIGURES

Global EV sales (including PHEVs) was 17M units, a YoY +25%, according to Rho Motion. I talked about the 23M and 11M in China, so let’s drill down a bit.

Murrica: 1.3M units on a base of ~16M total vehicle sold which would mean a take rate of ~8%, if we include our neighbor to the north that total is now 1.8M

EU +EFTA + UK = 3M

ROW = 1.3M

OEMs notable sales growth (or loss) in China:

Mercedes: -7%

Porsche: -28%

VW Group: -9.5% (including Porsche)

The US China 4 and a few other notables:

BYD: +41%

NIO: +39%

Li Auto: 49%

XPeng: 34%

Zeekr: 87%

LeapMotor: 104%

___

CHINA EVs & MORE

Here’s a link to the last China EVs and More episode of 2024. Our Year in Review episode.

We are back this week with our live show on Friday, 9am ET for those that want more interaction. You can also message me directly with questions if you’re not able to attend the live recording – I will try to answer it during the last part of the show.

We are live on these platforms: YouTube, Linkedin and X. See you there!

___

BY THE NUMBERS

$600M. That’s how much Ford earned from the China market in 2024. A decent percentage of that comes from Ford exported products like the Lincoln Nautilus that ships to places like …the US.

1.3K. What challenging relationship with the US? That’s how many exhibitors at CES were from China, more than 25% of the total 4.5K.

_________________

This weekly newsletter is a collection of articles we feel best reflect the happenings of the week or important trends that have effects on the global automotive and mobility sectors. We also provide a point of view that we hope educates and sparks debate.

The Sino Auto Insights team

China is most grateful for Elon Musk's prioritising the undermining of democracies rather than executing on new products - desperately needed years ago. Way to go Tech Bro Fantasist !!!.