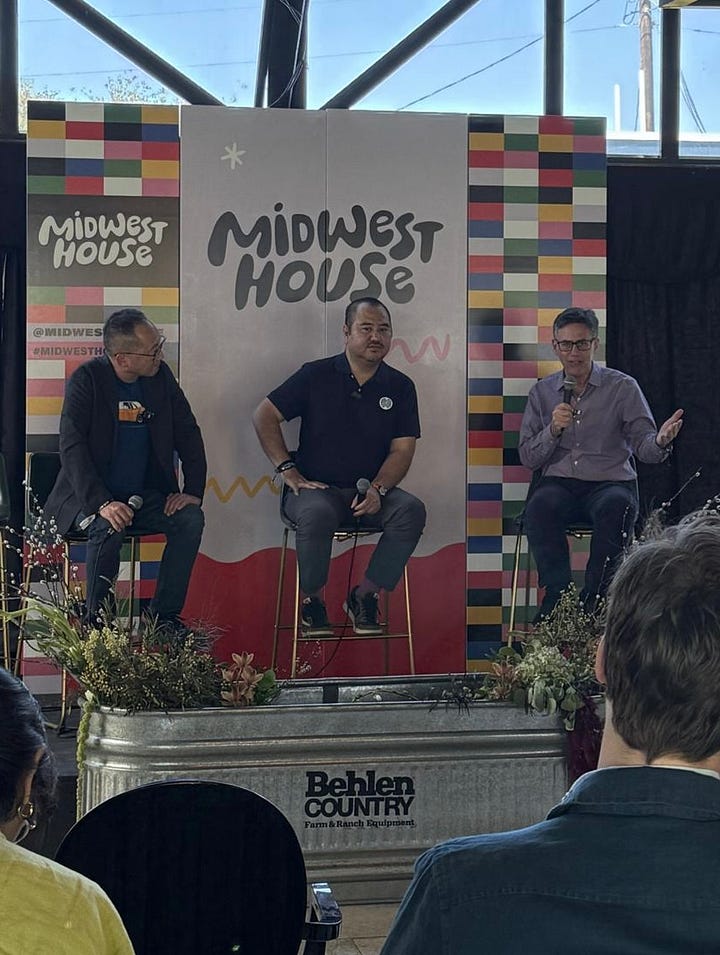

Had a great time in Austin, the weather was perfect and the discussion I participated in was lively with Steve Levine, editor of The Electric and Ed Kim, CEO of AutoPacific. But with these types of events, it’s always about the people, isn’t it? And because it’s Texas, the barbeque.

Ed Kim and I ended up at Iron Works Barbeque this time around for our fill, we were lucky since the line was barely out the door when we arrived. It snaked well outside the door by the time we hit the counter to order our sampler plate and sides.

Here are some snaps from the couple days I was there.

Pic #1 - Dinner with Norihiko Shirouzu

Pic #2 - Antler Pitch Contest

Pic #3 - Panelists pre-gaming

Pic #4 - Action shot of panel

Pic#5-7 - Iron Works Barbeque

I tried to call a Waymo, but wasn’t very lucky. Since it’s a partnership with Uber the robotaxis are integrated into their driver queue so it’s a crap shoot on getting one. In the 3-4 trips I took, no luck.

BIGGEST NEWS THIS WEEK

Tesla’s roller coaster ride of a share price. For investors, it must be like riding the Millennium Force at Cedar Point in Ohio – reaching all-time highs in December 2024 (~$1.5T valuation) before plunging more than 50% since.

Its currently settled at $777B after shares rose 7.6% on news from Elon that Tesla will double production in the US in the next two years. It’s actually quite unclear what he meant when he said he’d double ‘output’ and friend of Sino Auto Insights Sean McLain pointed to Elon potentially recycling an old commitment he made from a past nonsensical statement he made.

Elon is a polarizing figure, especially now that he’s defacto in charge of getting rid of what he deems as US Govt wasteful spending. That’s pissed off ALOT of his current and potential customers in the US. But he’s also made comments about European politics that have riled up would be customers there. Protests in front of Tesla stores have ensued. Trump as always, is quick to blame someone else.

But that’s just the last few months. Is Tesla even worth $777B let alone >$1T?? This isn’t investment advice, we don’t do that, but here are the facts. I’ll leave it to the Tesla STANs disguised as objective analysts like the person referenced in this Fortune article, who didn’t downgrade the stock but did say investors ‘patience was wearing thin,’ his lack of conviction in even saying that shows that he’s hedging bets. But what we do know as facts re: Tesla.

- The global growth rate of EVs in 2024 = 25%, Tesla’s growth rate in 2024 = -1%

- New (passenger vehicle) products in the last 5 years = 1, the Cybertruck (with a sub-$25K car on its way later this year according to Elon if we’re to believe his timing).

- If my estimates are correct, global capacity = ~2.2M units while sales last year were 1.8M which means utilization is 81% which isn’t bad, but as sales fall that utilization rate is going to fall drastically. With his statement about doubling output in 2 years, something’s gotta give. If he can’t keep those factories humming, that’ll place a HUGE burden on the higher costs / vehicle.

- According to Elon, Tesla is an autonomous driving / AI company - where the AI doesn’t work all that well. And in the largest market in the world, it has numerous competitors that want nothing better than to boast that it’s intelligent driving system is better than the limited version it’s recently launched in China. Tesla has even been rumored to call in for help to get their product right for the China market. Baidu is happy to help them and charge them for it too.

- Sales in its two most important markets (California and China) are falling. If you’re wondering why I write CA vs. USA, its because CA leads the US in EV adoption and historically Californians loved their Tesla’s …until last year. Some Tesla STANs may also point to Chinese consumers waiting on the Juniper refresh to launch and that could be a reason for its soft sales this year so far in China, but I know its more than that.

In my discussion at SXSW, friend of Sino Auto Insights, Steve Levine even predicted that Tesla would have NO GROWTH in 2025. I find growth hard to come by this year for Tesla as well, but believe that if the M2 comes out and is priced below $25K, it may have a chance of helping it move past the 1.8M units it sold in 2024 if it’s hits in the US and EU.

That’s because it’ll be an also-ran in China because there are plenty of great $25K EVs there already and Tesla’s idea of a $25K car usually means decontenting, which will only push Chinese consumers more quickly to their competitor’s products since they’ll have more features, including intelligent driving most of which will come standard.

As for his competitors, XPeng this week announced that the refreshed G6 which sits on about the same footprint as the Model Y, is coming out with even more features (many more than the MY’s) than last year’s version, will have a fairly robust L2+++ intelligent driving system standard and will be cheaper than last year’s version, how does $24.4K starting price sound?? That undercuts the MY by almost $12K. And it also comes with 5C charging which means that the pack should be 80% charged in 1/5 of an hour or ~12 mins.

And that’s just 1 competitor. Good luck indeed, Tesla.

___

GAC (with Huawei’s help) will (conditionally) do L3 autonomous THIS YEAR in China. This system will be launched on Xiangwang (not to be mistaken by BYD’s Yangwang) branded vehicles after showing off the S7, the first vehicle under that brand.

The hybrid S7 which is a feature packed, BIG, 5 meter long SUV that will include features like Dolby Atmos, a 634 mile range (with a full tank of gas), 11 sensors + LiDAR accompanied by Nvidia silicon to help run it’s L3 system and include DeepSeek Ai via future software updates. All this at a starting price of ¥209,800 or ~$29K!

___

How tariffs on aluminum could mean trouble for the Ford F150. As automakers have tried to make lighter yet more durable and sturdy vehicles, more and more have turned to aluminum to help them get there. It’s what Ford did 10 years ago when it decided that exterior panels including the hood, cab and truck bed of the F150 would be stamped using aluminum rolls.

Unfortunately, less and less aluminum is now smelted in the US. In Ford’s particular case, the aluminum is smelted in Canada. That was never an issue, until the Trump Administration came into office. He’s threatened to slap a 25% tariff on imported steel and aluminum starting on April 2nd. That’s even after a 1 month reprieve. This could raise the price of an F150 fairly substantially, which on average has a pricetag of about $60K.

Any sneeze in F150 sales will give Ford a massive cold, hence the last second pow wow between Trump and the CEOs of Ford, GM and Stellantis. GM and Stellantis will have their issues with aluminum being tariffed as well, but Ford’s profits aren’t terribly diverse with most of it coming from their F150 product lineup.

Well Legacy Auto, now what?

___

Another new EV company, but this one NOT from China? I love everything about the backstory on how Longbow came to be and how they believe they can beat the system when it’s not been beat, at least not without a substantially sized thumb on the scale from the US, EU or Chinese govt.

Their premise does make sense, but what’s not clear (because they are obviously trying to figure all this out for themselves) is where it’ll be built, how much Chinese tech will be in it (from the sounds of it, substantial amounts), who writes the code, and getting past the halo vehicles that they’ve now unveiled to the public of which they may sell in the 10’s of thousands and finally, the British brands, although chalk full of history and heritage, were NEVER well-managed.

If you don’t believe me, name one that hasn’t at least changed hands or needed a boost of investment from something or somebody. I’ll wait.

With all that said, I’ll definitely keep my eye out on this company since it could sprout other copycats that are also able to crack the code of competitively priced yet well-appointed clean energy vehicles that sell in decent volumes straight away because therein lies the rub.

SOMETHING THAT MAY ONLY INTEREST ME

30% of H-Mart shoppers are non-Asian. H Mart for the people. I shop at the H Mart that’s about 2 miles away about 1 / week. It’s ALWAYS busy. People are surprised when I tell them that the Japanese and Korean food aren’t bad in MI (vs. the Chinese food which isn’t great), but it’s because the Korean and Japanese OEMs sent folks over years ago and many of them never left.

When I was a kid, no one knew what pho or kimchi was, now it’s a staple among my anglo-friends who love it. Speaking of pho…

___

Next time I am in New York, I’ll definitely try to stop by Ha’s. I first heard about this restaurant when a short video about their popup showed up on my YouTube feed. I am ALWAYS an advocate for anyone that’s highlighting the amazing Vietnamese cuisine that I grew up with and to this day, if I am there for more than 2-3 days, will always find my way to a Viet restaurant when I am traveling, so I can check out that city’s pho.

I still have a preference for NorCal pho whether it’s near my old place in Sunnyvale or in Sunset District where my wife spent her teen years. It’s a part of who I am and for whatever reason, whenever someone tells me how much they enjoy Vietnamese food, I think of my mom…

CHINA EVs & MORE

Here’s a summary of last week’s episode:

We are back live this week at 9am ET on these platforms: YouTube, Linkedin and X.

See you there!

_________________

This weekly newsletter is a collection of articles we feel best reflect the happenings of the week or important trends that have effects on the global automotive and mobility sectors. We also provide a point of view that we hope educates and sparks debate.

The Sino Auto Insights team

When I go from the Shenandoah Valley to Dulles I always stop at H-Mart, but there's also a Lotte nearby. I've not done a count, but 30% non-Asian sounds about right. NOVA (northern VA) has a huge Korean community, the first H-Mart outside NY/NJ opened there in 1997. Since it's 3.5 hrs one-way, we take coolers with us. As to Detroit, Japanese and Chinese friends in downriver Detroit claim there's no good Asian food of any sort, they have to go towards Southfield/Troy.

Separately, Tesla raised the price of the Model Y refresh, but only for the entry-level version. That's not a good sign. Now that's typical of refreshes, they stem but do not reverse sales slides and discounting. As you note, the Model 3 is discounted, with an "insurance" subsidy of RMB8,000, a charging subsidy (3 yrs at 元1 per visit), and 5 years of free money. With discounts Model 3 sales have held up, but that's post refresh. With only 2 models and 950,000 units capacity in Shanghai, and Model Y exports falling steadily for 2+ years, Tesla won't be able to maintain capacity utilization. Back to drafting another substack post (on price wars) and a Chinese EV analysis for SeekingAlpha...

US analysts can't identify the cult brand staring them in the face......and some high profile investors are soiling their reputation.