SAI Weekly 14 - 25: Difference Between Us and Everyone Else, Short San Diego Trip, Packing for Shanghai

Just getting back from San Diego – a place I only visited 6-7 times when I lived in the Bay. Should’ve visited a lot more. Great city. I was there for a Qualcomm (QC) event. QC is working to create more awareness for their non-infotainment HW / SW stack including their intelligent driving and connected vehicle solutions so I spent the day with their team to learn more.

QC Snapdragon silicon is the GO TO for most OEMs that are serious about their front consoles / cockpits. With the exception of perhaps the lowest price passenger vehicles, consoles around the world (China EV Inc goes ALOT further with design and features of course) nowadays incorporate an iPad sized touch screen as the center console and a digital IP (instrument panel), which has also transitioned from analog to digital guages and in many cases be customized by the user to show different outputs and gauges – all powered and run using Snapdragon compute.

I can’t think of any OEM off the top of my head that’s not using them in at least one of their products, although I am sure there are.

This dominance crosses borders with customers from Europe, Japan, Korea and China as well. What many in the industry aren’t as familiar with is the other solutions they provide as part of their ‘Digital Chassis.’ That’s what they wanted me and about 20 other analysts – shout out to Pete Bigelow and Ed Kim who also attended – to take that deep dive with them. Their (almost) entire automotive leadership team was there to chat with us, present to us and to answer any questions we had. I had plenty.

This was a different tone than other ‘knowledge’ events I’ve been to. First, I don’t go to many of these events because I don’t see a ton of value in me going to them - a lot of regurgitation of what’s already out in the market from whoever is presenting it. I was pretty curious about this one though and thought even though I jump on another plane in two days to head to Shanghai for the show, this was worth a couple more days away from the family.

The most value was the access we were provided to the leadership and their interest in feedback – how could they better communicate their capabilities? Are we presenting what you want to know? Is this too wonky? Not wonky enough? One thing was certain and this is important, QC has the pulse of what’s happening (or not) in Europe and North America vs. China. I couldn’t help but think that the Chinese EV companies were pushing them and their silicon’s capabilities with the features they provide to their Chinese customers in their vehicles while Legacy Auto on the other hand was still trying to understand how much compute power the QC silicon is capable of and how to best optimize features to take advantage of that power. Another way to say this – China EV Inc knows how to get the most out of QC’s silicon, the traditional automakers, not so much.

The QC leadership that presented threw a lot at us so I’ll take a second before I completely download what I took from the day long event. Peculiarly, the head of the auto group was NOT there to be a part of the event.

Last week, friend of SAI Steve Levine posted on LI a summary of his latest newsletter. In the post, he quoted an analyst that is a well-known Tesla STAN who also gets a lot of air on a few prominent media outlets, I am just not sure why.

He effectively said the tariffs set back US tech 10 years. I chided Steve about giving that person credibility in a comment and got a – ‘Why is he wrong?’ and ‘Well, what’s your prediction and sources?’ from a few other commenters. Here is my answer to them.

First, Sino Auto Insights isn’t in the prediction business. We are in the business of helping companies grow and build their presence in the global mobility space. Next, we help organizations lay out what the current & future automotive / mobility environment, taking into account everything from specific or local market dynamics, investment opportunities / risks, players to pay attention to, policy shifts by local and federal govts, helping interpret those policy shifts, consumer preferences, market segments, etc.

We leave the ‘Click’ & ‘Follow’ chasing to those folks that haven’t actually travelled to China in the last few years or driven / tested the vehicles to see whether they are or aren’t actually better than the west’s best, but still stand themselves up as ‘experts.’

If you want to know who THOSE people are, ask them when the last time they were in China and / or if they have driven these cars, ridden the robotaxis or tried out the intelligent driving? Because I have. So that’s who my ‘source’ is. Why seeing, touching and feeling the latest products, features and services is important? Because blink and it’ll change on you. obsolescence occurs in months in China, not years. If you’ve not been to China consistently or in the last 2-3 years, what you saw isn’t the same as what’s out on the roads. I assure of that.

As for the Why’s he wrong question? I don’t know everything he said or the context of why he said it. What I do know is that he’s wrong ALOT and / or doesn’t have the depth of knowledge I believe that’s needed to make the definitive remarks he does, specifically about Tesla but about other things as well.

First off, it wasn’t the tariffs that set the western OEMs back 10 years. This didn’t ALL of a SUDDEN happen. Legacy Auto was behind already and if you’re wondering who’s my source for that? Wang Chuanfu, you know …the CEO of BYD.

Why you ask? Because the market changed right under their noses when they weren’t paying attention. As John Lawler said this week, which I post in a bit more detail below, the pace of change is speeding up, so if you’re not catching up, you’re getting further behind.

Till about 110 days ago, in the hard tech mobility space (automotive / micromobility / UAV / battery / chip) that meant either building in China and shipping to the world or building and selling into China. If you plan to sell into China, at a minimum you should know who your customers are, what they like and how they like it, next is who your competitors are, what their capabilities are and what may be around the corner in order to know how best to attack the market and your competitors.

Win in China and the payoff is ENORMOUS. Ask GM, VW Group, Porsche, ABB. But there are risks. And if you can’t keep up you’re gonna get left behind. Why is China so important for automakers? John Elkann mentioned this week that this year the Chinese automotive market could be larger than the US and European markets combined.

Rewinding to 2024, passenger vehicles sales in the US: 15.8M + EU (+ UK): 13M = 28.8M, China: 27.5M, so what Elkann stated is totally feasible, dare I say likely (?) especially since the EU and US markets are mature markets that aren’t going to grow in any significant way moving forward. Want to keep Wall Street happy? Find and exploit growth opportunities which in mature markets normally means taking customers from others. That makes for fairly high customer acquisition costs.

The tariffs throw ALL this into disarray and that’s where our team shines. We cut through the bullshit. We sit behind closed doors with our clients and lay out the different scenarios, responses, responses to responses and they ‘whys.’ No conceit when I say this, we are some of the best in the world at this. Name another person who’s lived / worked in Detroit, Silicon Valley and China? I’ll wait.

In addition to all of the above, there is no other market in the world as dynamic, cutthroat or competitive as China. It changes on a weekly if not daily basis. Do those experts know who these players are outside of the first 3-4 names most people already know? Likely not. I talk about it each week in this newsletter and in a weekly podcast.

Why I am fired up about this and many journalists understand this - because I am out there grinding, getting it done - some other lazy journalists who just want to finish writing their article on this or that subject don’t look beyond the 2-3 sources they’ve ALWAYS used when they can just ask them - ‘Before I quote you about your knowledge on this - have you driven this car? Have you been to China recently? Who’s your source?’

As a begin packing for my trip to Shanghai, I’ll jump off my soapbox.

Visit to Aptera. Cool solar EVs. Their first product is a two-seat halo vehicle, but the technology crammed inside is impressive. And on top of all that - it’s a motorcycle, at least that’s what the DOT treats it as. It has three wheels which makes it lighter without losing much balance and steadiness.

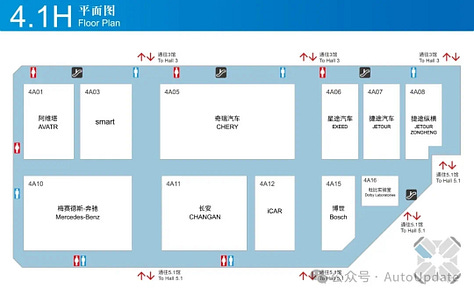

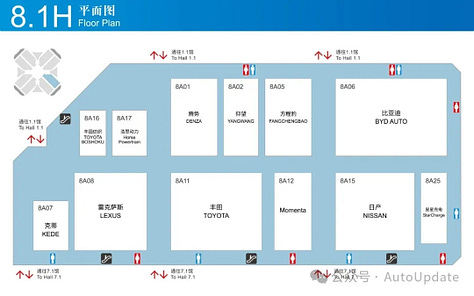

Below is I am making sure to pack my Hokas AND new Adidas. I am going to do ALOT of walking. Also, the NY Auto show was this week - the floor plan for that is cute (or lame) depending on your viewpoint. I posted both for scale.

BIGGEST NEWS THIS WEEK

What’s behind the GM curtain? This Bloomberg long-read pulls it back. It’s really tough to know what’s going on at the D3 since all I can see is major sales losses in China while new product launches seem to find lukewarm reception.

That said, this GM piece points to GM not slowing down on EV and as important, battery development. Bringing in Kurt Kelty was quite the coup for Mary and team. I tend to be tough with critique on GM sometimes because it’s SO frustrating with what I see as the slow pace of change, but according to this article that’s what is indeed happening, and what I don’t appreciate is that momentum is building.

This article indicates that the GM folks are saying all the right things. The question is – will the tariffs, China and software ultimately be their undoing? Because that takeoff runway that will allow them to fly with the BYD’s and Tesla’s gets shorter and shorter each day.

___

What Ford is saying about tariffs. Since GM got some air-time in this newsletter, it’s only fitting that Ford gets some ink as well. John Lawler, Ford’s ex-China head, ex-CFO and current vice-chairman said during a BofA Conference this week that tariffs would cripple the domestic automakers and blow up their profits. The profits they need to fund the development needed to make products that can compete with China EV Inc.

He finally outlines some interesting things, ‘somethings’ I’ve been pointing out since effectively the first newsletter, and that’s the inevitability of the Chinese coming, current development cycle time from clean sheet to job #1 is about 18 months, the market isn’t slowing down but speeding up and partnering is necessary and should lead to moving faster, the only way Ford can survive, Legacy Auto can survive. See GM & Ford + CATL, VW Group + XPeng, Stellantis + LeapMotor.

I am glad John agrees with me!

___

The other reasons - not cheap labor and subsidies - for China being manufacturer to the world. When generally describing goods from China, let’s lose cheap as an adjective. That’s outdated. Let’s start using the term ‘value’ more broadly. The quality price intersection that provides the best value to the wholesaler and ultimately the buyer is NOT something Europe or the US can hope to match anytime soon, if at all.

It's not likely in most industries anyway. Is it necessary in some sectors, I’d argue yes. But it will take time – we should be doing studies about how much more are US consumers / business customers willing to pay for certain products. With those data points, the US government then cross references that with the list of products that have national security implications and the products that aren’t as price sensitive but have national security concerns get reshored first.

I sound like a broken record for a lot of things I write about, reshoring being one of them. In some sectors we aren’t in the same league. In some sectors, we’re not even playing the same sport.

QUOTED

Had a nice chat with Steve Inskeep from NPR. I know NPR is a very reputable media outlet, but I didn’t realize its reach. The morning this posted, I had 6 people reach out to say something along the lines of ‘…just heard you on NPR, pretty cool!’

Listen to the short piece on Steve’s visit to a Chinese EV factory here.

___

Spoke to friend of SAI, Evelyn Cheng about eVTOL startup Ehang and their approval to begin paid flights in Guangdong. China’s literal rise in eVTOL’s mimics some of the EV sector. Government support, ambitious entrepreneurs, fierce competition, moving quickly to pilots and commercialization, dominate sector. Ehang roundin the bases to the ‘moving quickly to commercialize’ phase.

Foreign govts around the world that thought aviation was going to be spared from disruption in the short-term, think again.

___

Should China be pumping the brakes on wide adoption of Level 2 intelligent driving? I spoke to Rachel Cheung for this Wire China piece that examines the recent accident of a Xiaomi SU7 that killed it’s three participants. Details are still sketchy, but it points to the fact that everyone and their mother has their own version of and L2+++ system.

It’s a great article that breaks tries to make the case of too much toon soon. Here’s my contribution to the article:

BY THE NUMBERS

$197M. That’s how much it’s costing Lyft to go international. And yeah, I don’t include Canada as international since it’s still North America. Lyft is acquiring European app Free Now which operates in 9 countries. For those not familiar, Freenow is the joint app from Bimmer and Merc.

Lyft is still behind in other ways and is still much smaller than Uber, which operates in >70 countries, but the world can have more than one ridehailing apps, if only to keep each other honest. I use both apps so it’ll be nice when the Lyft app can be used in Europe as well.

CHINA EVs & MORE

Episode #206 - Trade War, Tesla Juniper Sales, Porsche China Needs a Hug

Please join us and message me directly with any questions you may have. Otherwise, find the recorded episode as an audio podcast or as video on the China EVs & More YouTube channel.

We are live on these platforms: YouTube, Linkedin and X. See you there!

_________________

This weekly newsletter is a collection of articles we feel best reflect the happenings of the week or important trends that have effects on the global automotive and mobility sectors. We also provide a point of view that we hope educates and sparks debate.

The Sino Auto Insights team