A few notable pieces of news that I opine on below.

One is the basics of payment terms to automotive suppliers, something that is getting stretched too thin in China due to the price war. Always remember, if suppliers can’t get paid and consequently can’t keep their doors open, the entire system crumbles. There’s a dangerous game being played right now in China, and it’s just starting to show itself externally.

This isn’t to say that other sectors globally don’t push suppliers pretty hard – as someone who dealt with suppliers in the US, EU, Asia in both the automotive and tech sectors – being a supplier to a large OEM (see GM, Ford, Apple) can be a pretty thankless job.

and I are finally getting around to kicking off our content platform At The Wheel. We’ve launched a Substack where all our recorded livestreams and special interviews will reside (alongside our eventual YouTube channel).For those who aren’t familiar, Joe White is a pullitzer prize winning automotive journalist who recently retired from Reuters, but rather than let him ride away into the sunset, I’ve pulled him into this digital platform – he’s as opinionated as me and now that he’s independent, wants to share his most opinionated opinions!

This platform will focus much more on what’s happening outside of China, but why I thought it was good to join forces with Joe is because we complement each other on our deep knowledge so I’ll pepper in China tidbits here and there as appropriate. Also, as someone who grew up in Detroit, let’s just say I ALSO have a few opinions.

I can’t wait to get this off the ground. We will kick it off next week with a Livestream on Substack, Tuesday, June 24th - 2pm ET, the link to the livestream is below.

https://open.substack.com/live-stream/36766?

Join us on this journey! If you’d like to be a guest or a sponsor for the platform, please do reach out.

BIGGEST NEWS THIS WEEK

OEMs stressing the system by holding payment to suppliers. I didn’t want to wade into these waters to try to predict how long this price war would last, but let me tell you when it started over 3 years ago I did NOT think it would last THIS long.

The stretched payment term is evidence there are enormous cracks in this foundation starting to show themselves externally. This is why the Chinese govt is weighing in. Below, based on my experience in sourcing, I explained how things should work and some of the ways OEMs can screw suppliers since MANY of these suppliers have no choice but to do their best to continue to ship product to the OEMs regardless of if they’re being paid or not.

___

What happens when you stretch out payments to suppliers

___

The Master Goods Agreement

___

17 Chinese OEMs including Geely and BYD, have come out to assure the government AND their suppliers that they will pay them within 60 days (likely of the invoice date). The suppliers are VERY skeptical. This isn’t a phenomenon or a unique characteristic of the Chinese automotive space or the global automotive space in general.

Holding onto cash is a business phenomenon, especially for companies that play in the hard tech / consumables space anywhere there’s inventory involved and long ship times. Remember that if it takes 60 days to get your product from China to US shelves, you need 60 days or inventory or else those shelves will be bear for each day you don’t have inventory for it. And that fluctuates too. THAT’s called forecasting.

Here's an early lesson from one of my mentors at GM, this should give you a good indication of how sourcing teams help the finance and accounting teams hold onto cash:

___

Luca De Meo is out. He has decided that he’d rather steer the boat of a luxury goods manufacturer than try to right Renault’s ship – effectively what I would call France’s national automotive brand. Regardless of what Citroën and Peugeot would tell you.

Before Luca arrived Renault, they were going absolutely nowhere partly due to the Carlos Ghosn debacle and partly due to COVID. Luca was able to turn Renault around culminating in a renaissance of the Renault brand in Europe at least – I attended the Paris Auto show last year and was amazed at the excitement for the brand as well as its sibling brands at the show.

The hometown crowd helped but I was really impressed with the relaunch of the Renault 5, so much so that I lugged a model of it home to the US!

Luca’s speech in its entirety

___

As for Renault’s future, they are effectively non-existent in the China market. About 30% of last year’s sales came from outside of Europe though so there’s something there. Did Luca leave believing that he did all he could for the company? Perhaps he saw even with Renault Group’s future product pipeline, they wouldn’t be able to compete in Europe vs. China EV Inc? The company he’s taking the reins of, Kering isn’t doing that great right now, but maybe he saw much more upside with them than he did Renault? Maybe he just wanted to take on that challenge of turning around a company with some iconic brands in its portfolio?

All speculation of course.

One thing that’s certain – Whoever replaces Luca will have some large shoes to fill because I am pretty impressed with what he was able to accomplish in just 5 years.

Here’s more speculation – Renault’s market cap is currently sitting at around $12B. Renault has a tremendously strong presence in Europe. Let’s say that market cap lavished and fell to $6-8B in the next couple years – it could make them a pretty attractive acquisition target for an up and coming Chinese player that wanted to immediately build a footprint in the EU.

Realistically, there’s less than a handful of China EV Inc that could swallow something like Renault whole like that. Further, the management, labor, cultural (including language), governmental challenges – the French government owns 15% of Renault – would be ENORMOUS.

I won’t mention any CEOs, but there have to be a few that have thought about it. Remember who the Renault China CEO is – Weiming Soh. He has strong relationships with many Chinese executives. I am also certain, he’s vying for that global CEO role as well.

I don’t think the French govt would want Renault to become a Chinese brand, but desperate times… We aren’t there yet, but in the future transportation world I envision, there will be BIG, BOLD moves that will need to be made in order to compete, which means that some brands will close while others reach across the aisle to find partners that in the past may not have made sense.

For those placing and taking bets – from my friend Nick Carey, it looks like there are two frontrunners to replace Luca …with Weiming being the dark horse of course.

___

Waymo headed to NYC. As we get to the imminent launch of the Tesla robotaxi in Austin this weekend, Waymo continues to expand its service in the US (at first, with safety driver), this time announcing that’s it’s going to enter NYC, well they’ve at least applied for the license to operate in NYC.

This is notable for a couple reasons. First, there are four seasons in NYC so how the service will handle the winter season will be interesting to see. I’d also argue that NYC has a pretty complicated, congested system and according to this, I would be correct.

I’ve driven in some pretty gnarly traffic all over the world and I’d put NYC’s right up there, although for different reasons of course.

I’ve also ridden using some intelligent driving systems and in robotaxi services in China and the US. The systems that stood out to me were Waymo’s and Pony’s on the robotaxi side and recently with BYD’s and NIO although those could be just recency bias on my part. Can Waymo work in NYC – after experiencing intelligent driving systems work in hectic China traffic, I think so.

___

Autonomous border crossing shuttles for trade? I see this and my eyes light up. Because I see the bridge between Canada and the US every week when I head down to Detroit and the challenges it poses to border crossing agents on both sides of the border. I also see how much freight gets shipped across from CA into the US, much of it auto parts headed to factories in Michigan and other parts of the Midwest.

That’s why something like this – if it makes sense for the US / Mexico border – would be great for the 25% of annual trade between Canada and the US that ships over on the Ambassador Bridge here in Michigan.

I do know that we are about to launch a new bridge with many more lanes that exits out onto I-75 rather than a residential area, but again this should still make sense and if we’re to ever make nice with our neighbors to the north, perhaps we can increase our trade surplus with them because we’ve made it much easier for both sides to ship stuff to each other.

I’ve heard of this company Green Corridors, but I need to find out more. Do one of the son’s have a recent investment in them????

BY THE NUMBERS

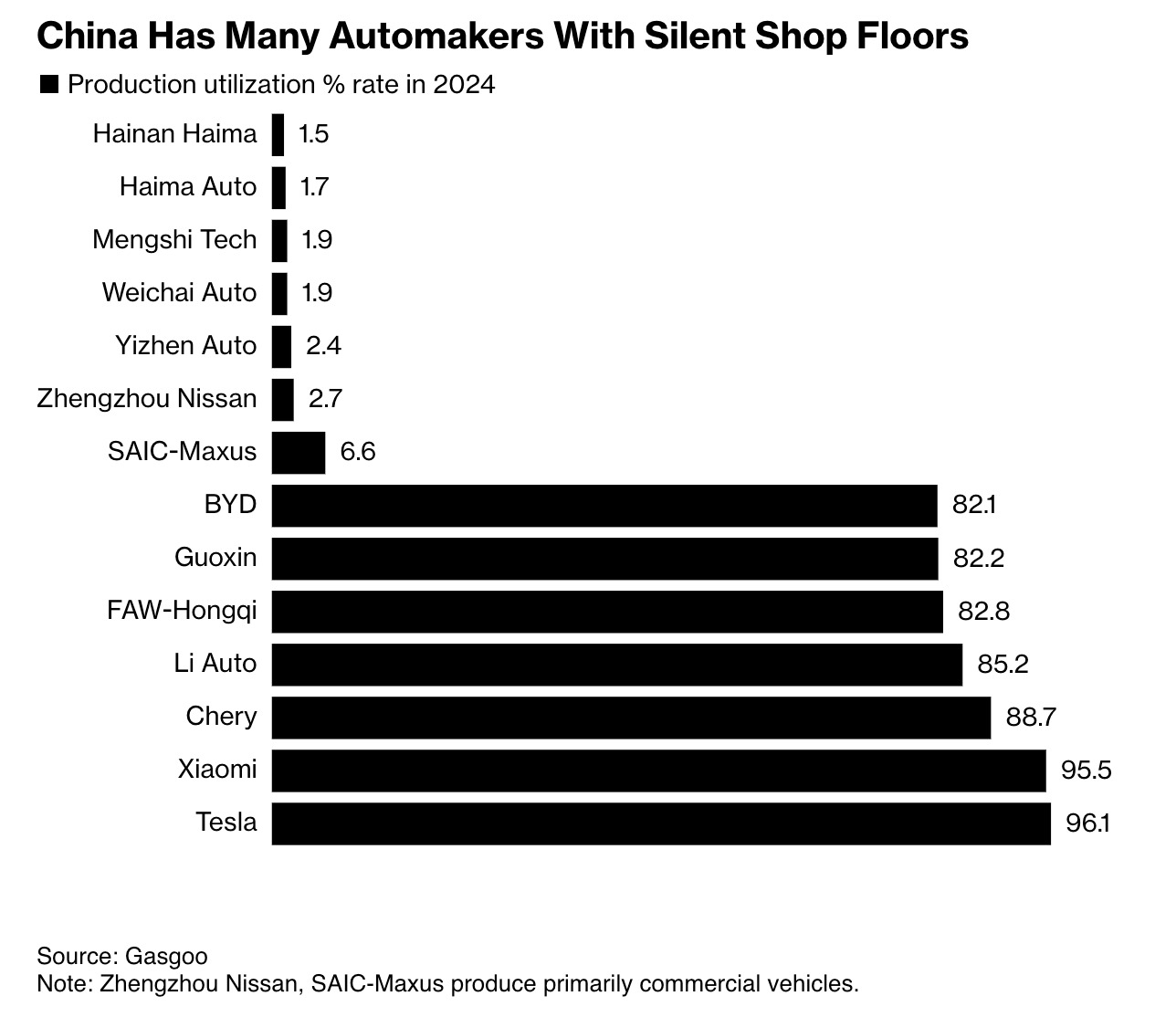

1.5%. That’s the utilization rate of Haima, a Chinese automotive company according to research from Gasgoo, a Chinese auto research firm. Gasgoo also estimated that sector wide utilization in 2024 was 49%. At that rate, there is NO ONE making any money, but therein lies the rub. Why is Haima still in business? I bet the Chinese govt even wonders this.

My back of the envelope estimate would be about 80ish percent of consistent utilization combined for a company’s factories in order for it to be profitable. That means that as a sector there is about 30% idle capacity that needs to go somewhere – either abroad or as in vehicles that are manufactured and sold at a loss.

Overcapacity has been a historical challenge for China, and not just in the automotive sector. When I first moved to China, I was told that to double whatever the annual sales volume was and that was a good estimate of what total capacity was. It seems still consistent with that rule of thumb. A reminder, I first moved to China in 2009.

CHINA EVs & MORE

We had a double drop this week of Episode 211 & 212, but this week I am just going to link to Part #2 of the CEM MAX Roundtable with Ed White, Jill Shen and Ethan Robertson as our guests:

Join us tomorrow, Friday - 9am ET on X, LinkedIn or YouTube for episode #213.

_________________

This weekly newsletter is a collection of articles we feel best reflect the happenings of the week or important trends that have effects on the global automotive and mobility sectors. We also provide a point of view that we hope educates and sparks debate.

The Sino Auto Insights team