A few major news bombs dropped this week. None really surprised me since it feels like I’ve been talking about a lot of this stuff for so long.

One narrative that’s being shattered this week is that Tesla, their products & technology are still the benchmark for EV manufacturers around the world. The notion is part driven by social media STANs / Ignorance is bliss from OEMs / Denial by the rest. For those wondering what a STAN is it’s another name for an obsessive fan coined after an Eminem song from 2000. For those that haven’t heard it, once you listen for a minute you’ll instantly understand why these folks are called ‘STANs'.’

Two things this week point to how Tesla’s challenges and lead / advantage over their competitors has evaporated in China and is likely to be overtaken in the US / EU within the next 18 – 24 months unless they’re able to push major refreshes on the 3 & Y while also launching that affordable 2 that’s been rumored and then rumored to be cancelled. That charging advantage they had, will now be absorbed by the many new EVs on the roads in the US over the next few years.

But as Elon said, don’t look at vehicle sales, look at their progress on AI and FSD. One that isn’t as insurmountable as many believe again, due to the China market. Are they worth trillions of dollars if they can only dominate one major global market?

The first piece that does a good job of comparing and contrasting Tesla vs. China EV Inc is this video posted yesterday by CNBC. I gave a decent amount of background for this piece and recommended the EVs that Eunice drives. For those wondering who aren’t able to make the trek over to China to try them on for size themselves, this is likely the next (and most recent) best thing.

Full disclosure: I am in the piece myself. With a couple of the other usual suspects, TWO of the three have been to China (or still live there) w/in the last few years FYI and have seen / driven the cars firsthand.

Now, that’s not to say that even those oft quoted analysts that DO have the travel expense accounts are still too lazy to take that (at least) 12 hour flight to see things for themselves.

Video courtesy of CNBC.

The other piece that illustrates Tesla tech vs. China EV Inc tech is below in the Zeekr post below.

___

This week’s China EVs & More - Episode #174 - July Sales, BYD Keeping Busy, Tesla FSD's China Competition

BIGGEST NEWS THIS WEEK

- Zeekr’s the fastest to charge battery. I was interviewed for this piece by the BBC about Zeekr’s new battery that claims to be the fastest charging in the world. We are talking 10% > 80% within 10.5 minutes. That’s fast! Innovations like this could erase the notion of wasting time at charging stations and / or range anxiety. There are requirements that need to be met to make this possible including using Zeekr’s ultrafast chargers.

And because of the ultracompetitive nature of the China market, we should expect breakthroughs like this to continue for the foreseeable future. Let’s be clear, these innovations aren’t driven by subsidies that’s for sure.

Evelyn compares the Zeekr battery’s charge speed to Tesla’s and no surprise here. It’s slower. For those that don’t believe this is possible, it is. I witnessed firsthand how fast a Li Auto MEGA using an 800V system could charge. Lightning fast. What that does for battery degradation is a topic for another day.

This battery will be used on the 007, a midsized sedan which begins shipping next week. So it’s also not some pie in the sky breakthrough that still needs time to marinate.

Let me also say that CATL, Gotion and BYD likely aren’t waiting around for their customers to complain about how slow their batteries charge. And speaking of batteries…

___

- A Merc EQE blows up in Seoul and people are freaking out about it. And rightfully so. Battery fires are notoriously difficult to put out and they normally take hours and / or thousands of gallons of water before they do. This one happened just outside of Seoul and damaged 140 cars parked alongside it in an underground garage while also injuring a few dozen people. The Merc in question was NOT plugged in so the fire was spontaneous. Here’s the moment the battery pack caught fire captured on closed circuit video in the garage. Video via X.

The cells were sourced by Farasis, a Chinese battery company that’s the 15th largest in the world. Mercedes also happens to be an investor in Farasis, owning about 3% of the company from an investment back in 2020. Mercedes was hoping that Farasis could be their supplier for cells in the EU but a factory that was planned a few years ago never materialized because Farasis wasn’t ready for the bright lights.

That’s why Mercedes approached CATL and now have multiple sources for their cells: SK, Farasis, CATL. No clear reasoning behind the fire just yet, but some building management in South Korea has banned EVs from parking and charging in their facilities. A larger conversation regarding the danger of EVs is building in Seoul and there will likely be some significant changes to how EVs are dealt with. This may also lead to these same conversations in the EU and US.

The massive fire has forced OEMs in South Korea to reveal who the sources for their EV cells are and that’s started to be communicated voluntarily by the Korean and German OEMs there. As more EVs hit the roads around the world, unfortunately there will be more battery fires, it’s just a numbers game. But identifying quality spills and / or better ways to deal with fires when they do occur is something that’s way overdue.

What’s not clear yet is which type of battery the EQE used, but it’s likely an NCM pack which is known to be more volatile with a much higher risk of thermal runaway. Will update as more details emerge.

___

- Tesla sees robotaxis as their way to a multi-trillion dollar valuation, but the current king of ridehailing Uber doesn’t see it that way. Dara Khosrowshahi, CEO of Uber believes that there are other barriers to Tesla’s path towards robotaxi domination including the owners of said Teslas who likely wouldn’t want their cars to be used by strangers for hours at a time.

I think there’s a world where both could be true. Demand for Uber rides and those that would just as soon use someone else’s car to hitch a ride in, of course pricing & availability (driven by demand / price) for the both will likely be a main deciding factor for which could succeed so the larger the install base, the bigger the chance of amortizing capital costs over a larger set of transactions – who wins long-term here? I still haven’t gamed this out completely in my head convincingly one way or the other. Would love to hear others thoughts on this so throw them in the comments section.

___

- No, Hesai you’re alright after all. Hesai has been taken off the US govt’s black list which forbids components being sourced for US defense contracts from companies on that list. The legal rationale for being put on the list didn’t have a leg to stand on apparently if it was to go to court which Hesai, which sued the US govt wanted to do.

For those who aren’t familiar with Hesai, they are the largest LiDAR company in the world and specialize in low priced LiDAR, oh and they boast about ~50% market share.

___

- China Silicon Inc is getting closer. The US restrictions on the purchase of capital equipment from companies like ASML, Lam, KLA and Applied Materials used for fabricating silicon / chips used to train AI models is pushing the Chinese domestic players to work harder to engineer suitable replacements for the equipment. Their current push has shaved years off the self-sufficiency drive according to one of the CEOs of these companies who spent years in the sector in the US. But those companies aren’t standing still either - which makes for a real 21st century competition between China and the ROW.

___

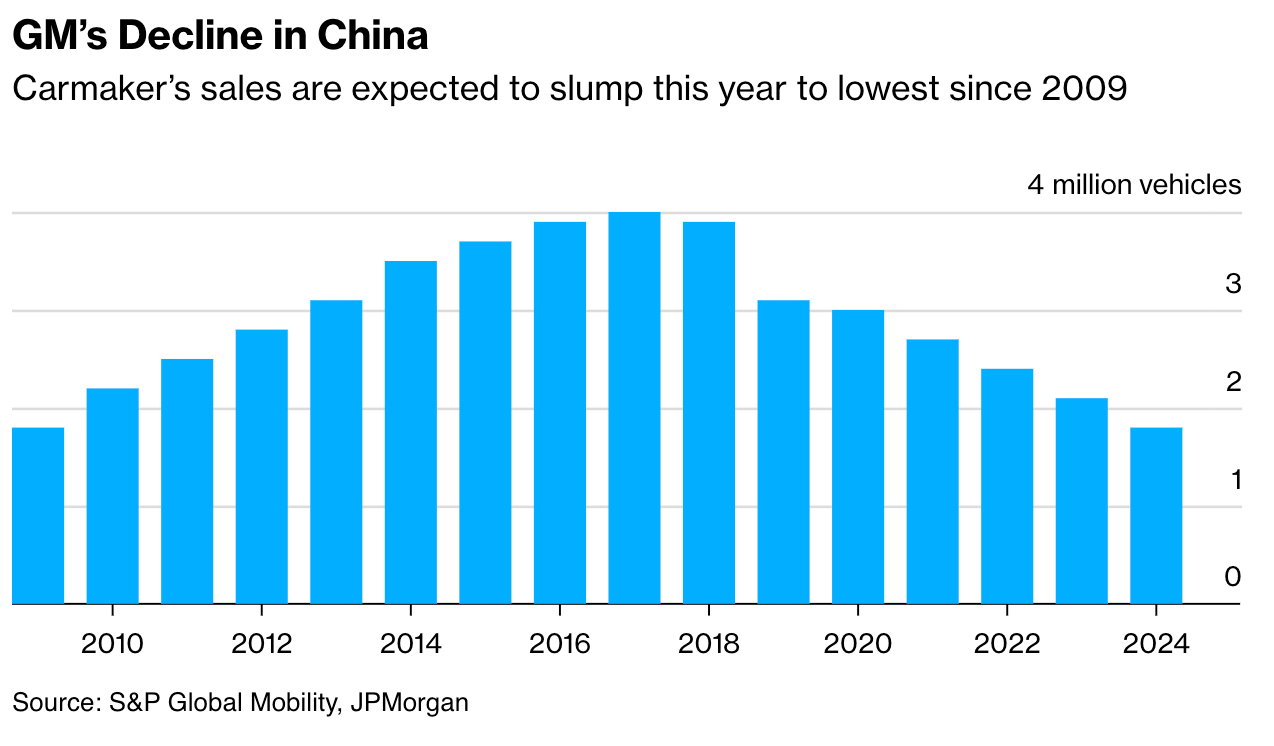

- GM is getting much, much smaller in China. They plan to restructure their China operations after years of falling sales and new products that do not resonate with the Chinese consumer. There’s a shift in strategy as well as they look to downsize not only staff, but their China manufacturing footprint, produce more EVs from that smaller manufacturing footprint, and import high margin vehicles from the US. Importing from the US is not going to get them any real gains in sales volume.

To reduce capacity in China, they’ll need the cooperation of their JV partner SAIC. That’s not guaranteed. For those of you who have read this newsletter and / or listened to the podcast, this news should NOT come as any surprise. That type of sales loss was never going to support business as usual.

The bigger takeaway should be that the staff reduction means that GM isn’t confident that they’d be able to get the lost sales back. With GM not in Europe, they become a North / Latin American dominant company. Is that enough? And who’s fault is it that it got to this point? I mean, someone has to be blamed, right?

If you want to see the roller coaster ride that’s ONLY been downhill the last several years, see below. Graph courtesy of Bloomberg.

BY THE NUMBERS

- <20K. How many vehicles HiPhi has sold since its founding in 2017. It’s now filing for bankruptcy after not being able to court a white knight to bail it out of its troubles. There will be more bankruptcies, not likely as fast as many think, but more will wave the white flag within the next 18 months.

- $483M. That’s how much Aurora Innovation raised in a public offering giving them a capital runway into 2026. Aurora is one of the last standing US AV companies still fighting the fight to get autonomous vehicles on the road, in this case for Over The Road longhaul delivery. With close ties to Pittsburgh and Carnegie Mellon, of course I am rooting for them to be successful!

- $19K. That’s the ceiling for the MSRP of the Mona M03 sedan by XPeng when it launches later this month. The dimensions are eerily similar to the Tesla Model 3. But undercuts it on price, even in China by more than $10K.

_________________

This weekly newsletter is a collection of articles we feel best reflect the happenings of the week or important trends that have effects on the global automotive and mobility sectors. We also provide a point of view that we hope educates and sparks debate.

The Sino Auto Insights

Elon muscled his way into being the face of the Tesla revolution and has now done his very best to bring into disrepute the brand by way of his self-serving indolence at the shareholders expense - but his personal benefit - for which said shareholders rewarded him for his destructive diligence in prioritising his own agenda over those who regard him as a genius. In that sense it's true. It takes a true genius to take down so many for so much for so long .....and be still loved for it.

All this focus on government support for Chinese auto makers is just a bit myopic. GM and Ford were on the verge of bankruptcy when President Obama bailed them out in the global financial crisis. The UK government (rather poorly) intervened regularly to support UK Car manufacturers. In short name a large car manufacturer that at some time or another has not received State support?